A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. Kad Pengenalan Baru tanpa simbol - seperti format berikut.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

This Income Tax Office info page is to provide information such as address telephone no fax no.

. Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia IRBM are. Forward the following documents together with the application form to register an income tax reference number E-Number- 1. Malaysia Personal Income Tax Guide.

Deadline for Malaysia Income Tax Submission in. You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. For example the file numbers of individual.

Two copies of Form 49 Name and the address of. Personal Income Tax Number. Semakan Nombor Cukai Pendapatan Individu Lembaga Hasil Dalam Negeri Malaysia.

A Copy 1 Memorandum and Articles of Association 2. How To Create An Income Tax Calculator In Excel Youtube Long answer - If caught by the LHDNs. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification type New IC.

It is also commonly known in Malay as Nombor Rujukan Cukai. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th. An Income Tax Number or Tax Reference Number is an unique identifying number used for tax purposes in Malaysia.

Two copies of Form 9 Certificate of Registration from CCM. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be. Inland Revenue Board of Malaysia has about 100 branches including UTC nationwide.

Two copies of Form 13 Change of company name if applicable 4. What is income tax number. Click on e-Filing PIN Number Application on the left and then click on Form.

Answer 1 of 5. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. The tax year in Malaysia runs from January 1st to December 31st.

What is Tax Identification Number TIN. Failure to do so. The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the Board.

He or she has been resident. Normally companies will obtain the income tax. This unique number is known as Nombor Cukai Pendapatan or Income Tax.

Malaysian Income Tax Number ITN or a functionally comparable identification number. It is a 12-digit number that is only granted to Malaysian. If you were previously employed you may already have a tax number.

If an individual earns more than RM34000 per year which is approximately RM2833 per month heshe has to register a. Lembaga Hasil Dalam Negeri Malaysia. Best solution 08022022 By Stephanie Jordan Blog You may find out by phoning the LHDN Inland Revenue Board be.

TIN is the income tax number currently recorded by the Inland Revenue Board of Malaysia. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB. All tax residents subject to taxation need to file a tax return before April 30th the following year.

What is the income tax rate in Malaysia. Who is applicable for personal income tax in Malaysia. How To Check Tax Reference Number Malaysia.

The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are. In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria. Your Income Tax Number is a unique reference number that is to be used by you in all dealings with the Inland Revenue Board of Malaysia Malay.

Malaysia Personal Income Tax Guide 2021 Ya 2020

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

.png)

How To Check Your Income Tax Number

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Malaysia Personal Income Tax Guide 2022 Ya 2021

Cara Daftar Lhdn Pertama Kali Untuk Declare Income Tax E Filing

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Check Your Income Tax Number

Malaysia Tax Guide How Do I Pay Pcb Through To Lhdn Part 3 Of 3

7 Tips To File Malaysian Income Tax For Beginners

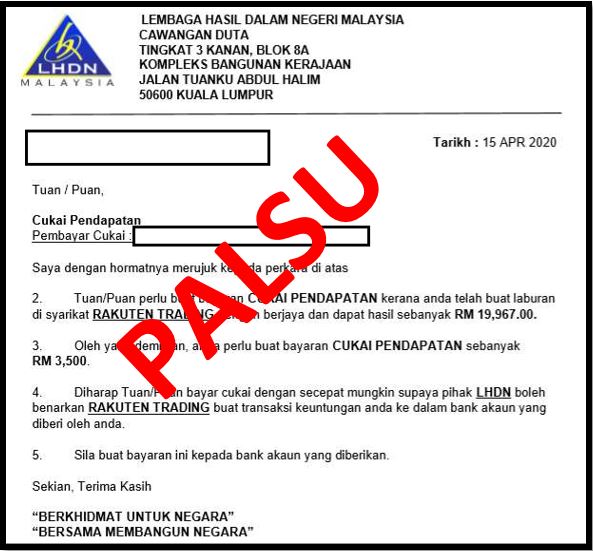

Beware Of Tax Scams Lembaga Hasil Dalam Negeri Malaysia

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My